Don’t Be Their Next Victim: The Ultimate Guide to Social Media Scams

August 20, 2025 | Varanasi, Uttar Pradesh

The sound of temple bells mixes with the chants of the priests. At Dashashwamedh Ghat, thousands of earthen lamps flicker against the darkening sky as the Ganga Aarti begins. It’s a magical Varanasi evening, and you pull out your phone to share it, going live on Instagram for all your friends and family to see.

As you pan your camera across the mesmerizing scene, you feel a sense of connection, sharing the spiritual heart of your city with people you care about. But what else are you broadcasting? Your exact, real-time location. The fact that your home is likely empty. The faces of the people you are with. For a scammer, a stalker, or a thief watching from the shadows of the internet, this isn’t a sacred moment—it’s a golden opportunity.

This is the paradox of our digital lives. An act of joyful sharing can unintentionally become a beacon for those with bad intentions. Scammers study our online lives like a biography, learning our routines, our friends’ names, and our biggest dreams, all to craft the perfect trap.

This guide is your shield. We will take a deep dive into the nine most common scams hiding in your social feed and give you a clear, powerful defense plan to protect your money, your data, and your peace of mind.

The Scammer’s Playbook: A Deep Dive into the 9 Most Common Traps

Cybercriminals are not technical geniuses; they are masters of human psychology. Their scams are designed to exploit our most basic emotions: trust, love, hope, and fear. Here’s a detailed look at their playbook.

-

The Clone in Your Contacts: Impersonation Scams

It starts with a familiar face. A scammer creates a perfect “evil twin” of your friend’s profile using their public photos and name. This clone account sends you a friend request. Once you accept, the trap is set. An urgent, emotional message arrives: a medical emergency, a stolen wallet. They are banking on your immediate trust in that familiar profile picture to make you send money without thinking.

- Red Flag Checklist:

- You receive a friend request from someone you’re already connected with.

- The new profile has very few posts or photos, all uploaded recently.

- The message contains a high-pressure, emotional story and an immediate need for money.

-

The Digital Romeo: Romance Scams

They appear in your DMs like a dream—attractive, successful, and completely devoted to you in a matter of weeks. This intense affection is a manipulation tactic called “love bombing.” After building a deep emotional fantasy, the crisis inevitably strikes. They need money for a plane ticket to finally meet you, for a medical bill, or to get out of trouble. They aren’t selling love; they are selling a carefully crafted lie to exploit loneliness.

- Red Flag Checklist:

- They profess love very quickly and intensely.

- They consistently have excuses to avoid a real-time video call.

- Their profile seems too perfect, like a model from a magazine.

- They ask for money, gift cards, or your bank account details.

-

The Prize That Costs You: Fake Giveaways

“Congratulations! You’ve won a new iPhone 16!” The message, often using the logo of a famous brand, makes your heart skip a beat. But here comes the catch: to claim your prize, you just need to pay a small, refundable “processing fee” or “tax.” It seems like a tiny price for a huge reward, which is exactly why it works.

- Red Flag Checklist:

- You “win” a contest you never entered.

- You are asked to pay any amount of money to receive your prize.

- The message has a sense of extreme urgency, pressuring you to pay immediately.

-

The Dream Job Deception: Fake Job Offers

A “recruiter” from a prestigious-sounding company contacts you on LinkedIn. The salary they mention is incredible. The interview process is surprisingly easy, often just a text chat on Telegram or WhatsApp. You receive a professional-looking offer letter. Finally, the hook: you need to pay for “document verification,” “training materials,” or a “security deposit.” They are weaponizing your professional hopes against you.

- Red Flag Checklist:

- The job offer seems too good to be true.

- The entire hiring process is conducted over messaging apps, with no face-to-face or video interaction.

- You are asked to pay money for any reason. Remember: Companies pay you; you don’t pay them.

-

The Get-Rich-Quick Fantasy: Investment & Crypto Scams

“Guaranteed 30% monthly profit!” The ads and private groups on Telegram and WhatsApp promise impossible returns. They show fake testimonials of people who have become rich overnight. A common tactic is the “pig butchering” scam, where they “fatten you up” by letting you invest a small amount and make a quick, fake profit. Once they have your trust, they convince you to invest your life savings, and then they disappear.

- Red Flag Checklist:

- Promises of “guaranteed,” “no-risk,” or impossibly high returns.

- Pressure to invest immediately due to “limited spots.”

- All communication happens on unregulated messaging apps.

-

The Dangerous Click: Malicious Links (Phishing)

“OMG, I can’t believe they posted this video of you!” The message, appearing to be from a friend, sends a jolt of fear and curiosity through you. You click the link without thinking. It takes you to a fake Facebook login page. You enter your password to “see the video,” and in that instant, the hacker has full control of your account.

- Red Flag Checklist:

- A message that is shocking, gossipy, or creates intense curiosity.

- Shortened or strange-looking URLs.

- A link that leads to a login page, even though you were already logged into the app.

-

The Marketplace Mirage: Fake Deals & Payments

You’re selling a chair on Facebook Marketplace. A buyer agrees to the price and sends you a QR code, telling you to scan it to receive the payment. But when you do, money is deducted from your account. Or you’re the buyer, and a seller convinces you to pay upfront for a product that never arrives.

- Red Flag Checklist:

- Prices that are drastically lower than the item’s value.

- Sellers who refuse to meet in person or only accept unsecured payment methods.

- Buyers who send a QR code for you to “receive” money. (Remember: You only scan QR codes to PAY).

-

The Friend-in-Distress Ploy

This is a brutal trick where a hacker gains access to your friend’s actual account. They then send a frantic message to everyone on their list: “I’ve been robbed in another city and need money for a bus ticket home. Please help!” Because it’s coming from their real profile, it feels devastatingly legitimate.

- Red Flag Checklist:

- The story is dramatic and requires immediate action.

- The friend is suddenly unreachable by phone.

- The writing style seems slightly “off” for your friend.

-

The Artificial Impostor: Deepfake Scams

This is the new frontier of fraud. A scammer takes a short audio clip of your son from an old Instagram story and uses AI to clone his voice. You get a call. It sounds exactly like him, panicked, saying he’s been in an accident and needs money sent immediately. Your protective instincts override all logic.

- Red Flag Checklist:

- An extremely high-stakes, emotional request out of the blue.

- Pressure to send money immediately without talking to anyone else.

- The caller discourages you from calling them back on their regular number.

From Dream Job to Digital Heist: A Real-World Case Study

Rahul, a 23-year-old engineering graduate from Hyderabad, was contacted on LinkedIn by a “recruiter” for a prestigious aerospace firm. The profile looked perfect. After a quick “interview” over Telegram, he received a dream offer letter with a salary of ₹12 Lakhs per annum.

Overflowing with excitement, he didn’t question it when the “HR Manager” asked him to pay a series of “refundable” fees for document verification, a laptop deposit, and training, totaling ₹45,000. The moment the final payment was sent, the recruiter’s profile vanished, and the phone numbers went dead. He wasn’t just robbed of money; he was robbed of his hope.

Deconstructing the Scam: The Red Flags Rahul Missed

- Unprofessional Communication: A real interview for a high-paying job is never conducted solely via a messaging app.

- The Request for Money: Legitimate companies have budgets for hiring and training. They will never ask a candidate to pay.

- Pressure and Urgency: The “limited time” nature of the offer and fees was designed to make him act before he could think or do more research.

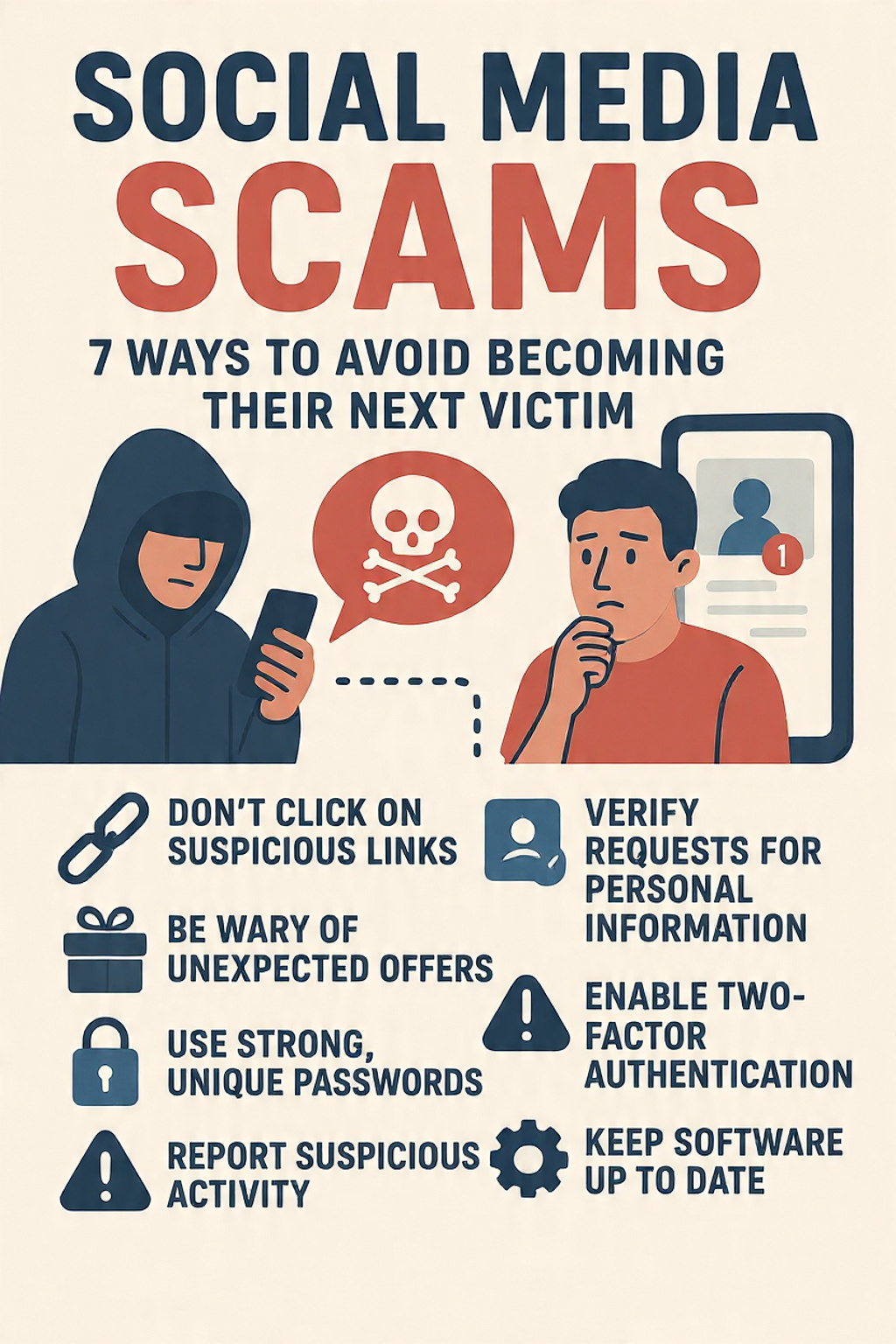

Your Universal Scam Shield: 3 Unbreakable Rules of Digital Self-Defense

You don’t need to memorize every scam. Adopting these three core habits will protect you from almost any trap.

- The Golden Pause: Your Brain’s Best Defense Scammers create a storm of emotion (fear, greed) to trigger the reactive, panicked part of your brain. Your defense is to STOP. Take one full minute. This pause allows the logical part of your brain to catch up and ask the simple question: “Does this make sense?”

- The Verification Rule: Never Trust, Always Check Never trust a request within the same channel you received it. If you get a suspicious email from your bank, don’t reply—open your official banking app separately. If you get a frantic WhatsApp message from a friend, don’t text back—call them on their phone. This simple act of switching channels is your most powerful verification tool.

- Activate Your Digital Fortress: Passwords and 2FA Your first line of defense is a strong, unique password for every important account (use a password manager to keep track). Your second, non-negotiable line of defense is Two-Factor Authentication (2FA). Think of 2FA as a second lock on your digital door. Even if a thief steals your password (the first key), they can’t get in without the special, one-time code that gets sent only to your phone (the second key).

Code Red: Your Step-by-Step Guide for When You’ve Been Scammed

If the worst happens, do not panic and do not blame yourself. Act immediately.

- The Golden Hour – Call 1930: This is India’s National Cyber Crime Helpline. If you’ve lost money, call this number immediately. Reporting within the first few hours gives authorities the best chance to freeze the transaction.

- Lock Down Your Accounts: Call your bank and ask them to freeze your card and account.

- Gather Evidence: Take screenshots of the scammer’s profile, the chat history, and any transaction details.

- File an Official Complaint: Go to the National Cyber Crime Reporting Portal at cybercrime.gov.in and file a detailed report with all your evidence.

- Warn Your Network: Inform your friends and family about the scam. This prevents them from becoming victims and provides you with emotional support.

- Secure and Scan: From a trusted device, change all your passwords. Run an antivirus scan on any device you think may have been compromised.

Conclusion: From Potential Victim to Empowered Guardian

The digital world is a reflection of the real world—full of wonderful communities and hidden dangers. The scams we’ve discussed are not an attack on your intelligence; they are an attack on your human nature.

But you hold all the power. Your awareness is the light that makes their shadows disappear. Your skepticism is the lock they cannot pick.

Remember the one truth that cuts through almost every scam: if it sounds too good to be true, it is.

You are the guardian at the gate of your digital life. Trust your instincts, question everything that feels “off,” and share this knowledge with the people you care about. By staying informed and vigilant, you can embrace all the good the online world has to offer, safely and without fear.

FAQ

1. What is a social media scam?

A social media scam is a fraudulent attempt by criminals to steal money, personal information, or account access by pretending to be trustworthy on platforms like Instagram, Facebook, or WhatsApp.

2. How can I identify if a message is a scam?

Messages that create urgency, ask for money, request OTPs, or come from unknown sources are often scams. Always verify the sender before responding.

3. Can verified accounts be involved in a scam?

Yes. Verified accounts can be hacked and used to run scams. Always double-check links, offers, and messages, even from profiles that appear authentic.

4. What should I do if I fall victim to a social media scam?

Immediately report the scam to the platform, block the sender, change your passwords, and file a complaint at cybercrime.gov.in or call 1930.

5. How can students protect themselves from online scams?

Students should verify job offers, avoid random links, never share OTPs or personal data, and always use official websites for applications.

6. Are work-from-home offers usually a scam?

Not always, but many fake work-from-home offers are scams designed to steal money or personal information. Research the company thoroughly before applying.

1 thought on “Social Media Scams: 7 Ways to Avoid Becoming Their Next Victim”

I do not even know how I ended up here but I thought this post was great I dont know who you are but definitely youre going to a famous blogger if you arent already Cheers